Indirect Tax Determination Engines – Dispelling the myths

Earlier this spring, we hosted a webinar covering basics of tax engines and their implementation for tax and finance professionals. In this blog, we want to summarise our key points to help tax and finance professionals to understand the possible role and benefits of implementing a tax engine.

Earlier this spring, we hosted a webinar covering basics of tax engines and their implementation for tax and finance professionals. In this blog, we want to summarise our key points to help tax and finance professionals to understand the possible role and benefits of implementing a tax engine.

With the trend of digitalisation of the tax authorities, in which near real-time reporting and e-invoicing has already been adopted in many countries across the globe, real-time tax determination is more important than ever before.

The reporting and filing requirements imposed by governments and tax authorities, requires a huge effort from an organisation to be compliant, and requires sophisticated indirect tax setups in the ERP systems. This is why cutting edge technologies, such as tax engines, are critical for compliance and for a smooth business operation.

What is a tax engine?

A tax engine is an application which contains a logical grouping of rules and rates by jurisdiction that allows to automate the tax calculation function. Its primary function is to calculate indirect tax receivables and validate payables. Tax engines are able to support a wide range of indirect taxes, including VAT, GST and Sales and Use Tax.

Benefits of using a tax engine

- Content: A tax engine is able to maintain global indirect tax rates and product-specific tax codes independently of the organisation. This allows for indirect tax determination to be automatically updated without having to spend time and effort in tracking changes to indirect tax rules and rates and translating these into ERP configurations.

- Automation: Many billing and purchasing systems are restricted in the manner in which they can determine and report indirect taxes. As such, many transactions will require human intervention from an indirect tax perspective. A tax engine will exclude or at least significantly reduce the level of manual intervention required. This, combined with automatic content updates, leads to more accurate indirect tax determination and a lower indirect tax risk.

- Scalability, Security and reliability: Tax engines are hosted in the cloud which enables convenient, ondemand network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction. Clients will not need to invest in infrastructure while their operations grow.

- One global solution: Tax engines allow one global and harmonised solution and approximation for tax determination across a company. This creates a wide range of impacts within an organisation, ranging from increased productivity to efficiency and a reduction in intense human hours.

How it works

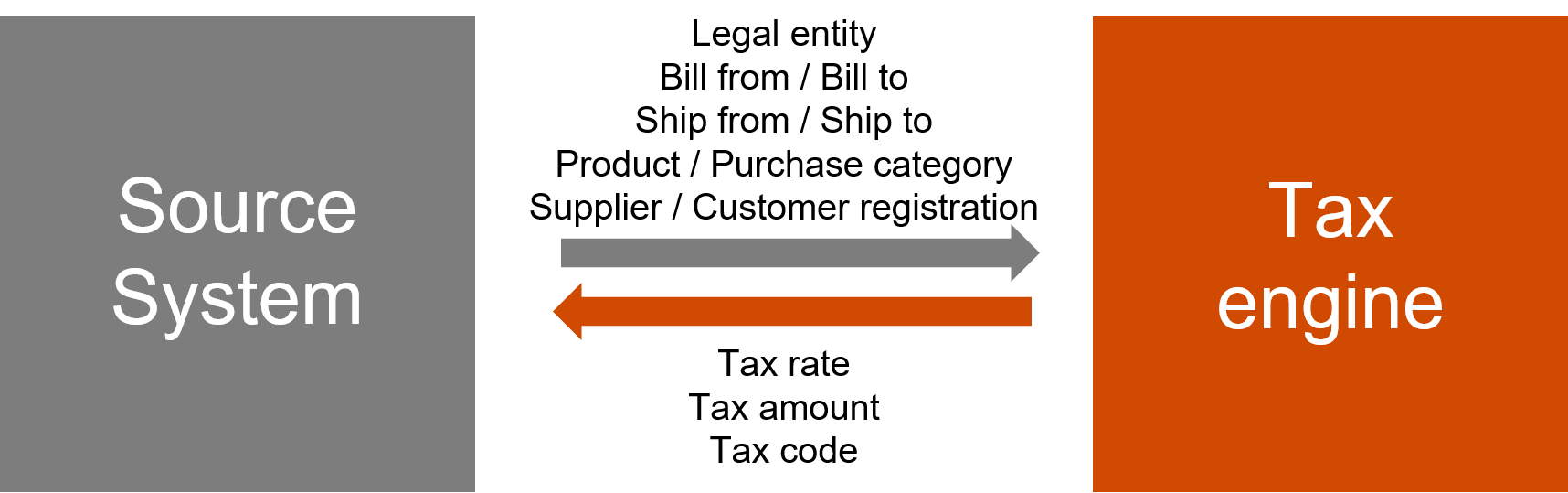

A tax engine is a third party software that needs to be implemented and connected to the transaction processing system or systems (ERP or otherwise). A single tax engine can be connected to many different source systems. The image below shows a high level description of how an integration between a source system and a tax engine works. From an end user perspective, the source system will send different attributes and the tax engine will provide a response with the tax rate, tax amount and tax code.

Is it really an open heart surgery to implement a tax engine?

PwC has vast experience in implementing tax engines for clients, having deployed tax engines in 70+ countries for Sales and Use Tax (SUT), Value-Added Tax (VAT) and Goods and Services Tax (GST). The feedback from clients has been extremely positive and we are keen to continue delivering world-class solutions for our clients.

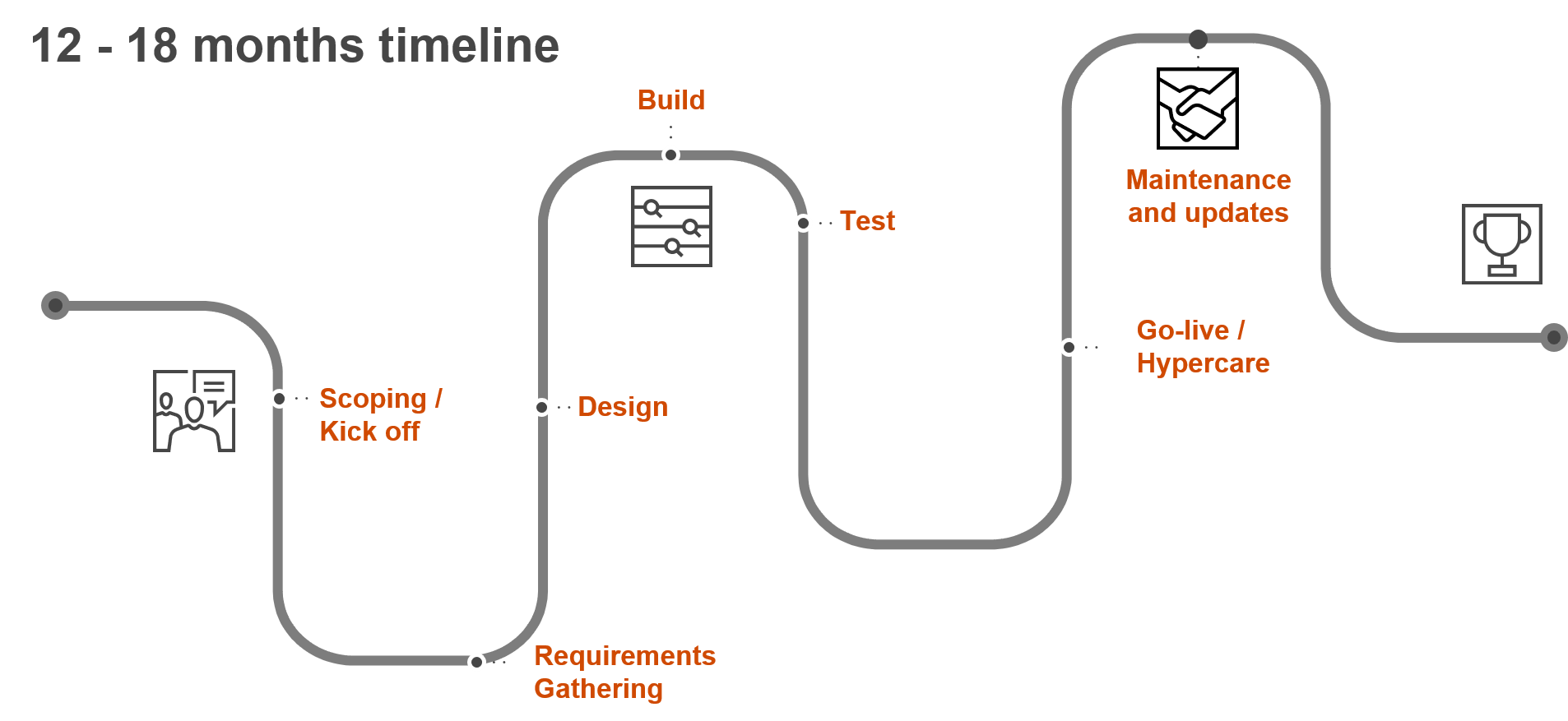

Tax engines are far from being an open heart surgery, they follow a defined project plan, which combined with our knowledge and experience make the entire customer experience really smooth.

The timeline for an implementation of a tax engine is shown below.

Next steps

If reading our overview makes you feel that you could benefit from the tax engine, you can reach out to one of our Nordic tax engine experts. During the proposal planning phase, we will identify your current source system setup, help you to prioritise the requirements and plan the proof of concept project. Proof of concept will be a fast and small demo of the tax engine to display capabilities and analyse a potential larger deployment. In case it proves to be successful, we will help you to scale tax engine setup to cover more jurisdictions, business units and scenarios.

Sergio Avalos

Alexandra Shtromberg